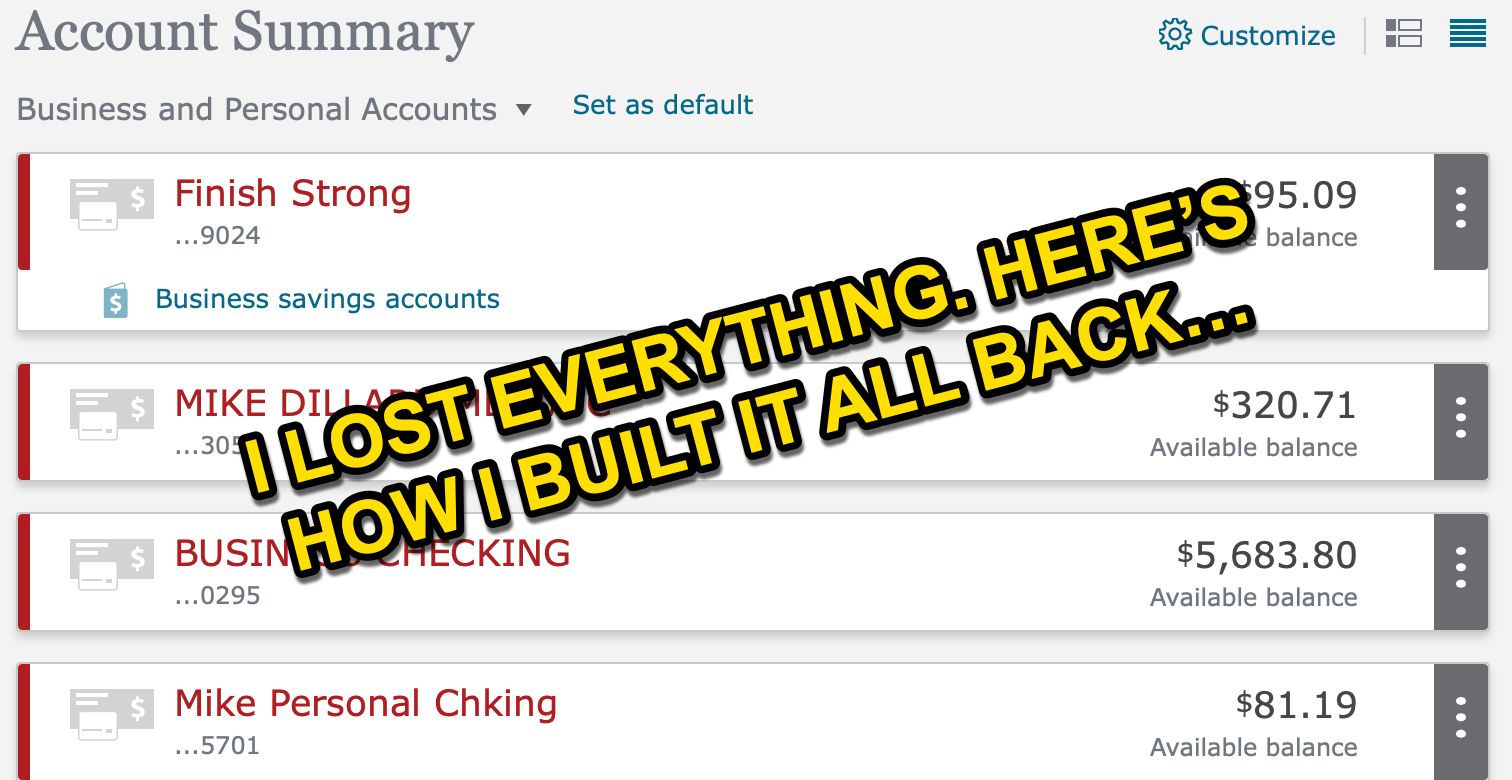

Just four years ago I went from having millions of dollars in the bank, to less than $6,000 to my name after suffering a life-changing brain injury.

Yesterday we dove into the physical and mental healing process I went through, and today I’m going to share the five practical things I did to start making money and building back my financial foundation.

Within 36 months, these steps allowed me to go from $6,000 in the bank, to over $3,000,000…If you have any questions, feel free to reply to this email and I’ll answer them personally or in the next update…

Step 1: Surrender Your Ego

And Cut Your Expenses…

One of the hardest things for any real entrepreneur to do is surrender and admit defeat.

We’d rather go down with the ship (our business) trying to bail out the water, than jump into a life-boat and watch our baby sink.

Unfortunately, that stubbornness just compounds the problem.

The smart thing to do is drop the ego, use your logic, and make a strategic retreat.

I didn’t do that for the first two years of my health crisis.

I always believed I’d be better and things would be back to normal in the months ahead. So I kept the cars, boat, my team, and the nice house as they drained my dry by the month.

But I was wrong. And that financial pressure just made the healing process 10 times harder.

I eventually surrendered and sold everything… The cars, the boat, and eventually ended up selling my stocks and gold just to keep the bills paid.

If I found myself in a similar situation again, I’d immediately cut ALL unnecessary expenses and get down to the bare basics… In fact, if I could go back in time I would have just bought a used Air Stream and parked it in the prettiest RV park I could find here in the TX Hill Country.

It was a mistake to try and hold onto the lifestyle I had and desired for as long as I did given the circumstances and just made things more difficult.

When my friend Aaron was worth 8 figures at one time in his business career, and then went through bankruptcy a few years ago after his new venture failed to get off the ground.

He ended up moving his wife and kids into his mother-in-law’s home around the age of 40.

Talk about humbling.

Then he got a job at a local gym as a personal trainer while I went through his dark night of the soul.

He did what he needed to do to rebuild his life. Four years later he was worth 8-figures again, and had a completely new relationship with money and investing that has allowed him to build a SOLID foundation for his family moving forward that will never put them at risk again.

Step 2: Become Aware Of Your Unconscious Patterns With Money…

This turned into one of the single biggest blessings from this entire toxic mold crisis…

As I went through the deep mental and emotional work I talked about here in Part 2, I became aware of something that had kept me stuck in a pattern 80% of entrepreneurs will also find themselves in…

I call it the “make it, spend it, risk it” cycle.

The vast majority of entrepreneurs I know had a highly adrenalized childhood… Usually as the result of trauma related to bullying, abuse, or neglect.

This adrenalized state is our “normal” way of being. And it’s why we’re so comfortable taking the kind of risks entrepreneurs take.

It’s what drives us to go all in, take risks like climbing Everest, or race cars on the weekend.

When money comes in, we’ll always find something to spend it on like a new YouTube studio or office, or we’ll find something to risk it on like a friend’s new venture, or another business idea we’ve had.

All of these decisions will make logical sense to us just like they did for me, but in reality our brains are literally just chasing adrenaline.

When things get “good” and “easy”… When the business is profitable and working as intended… We feel bored and uninspired because that adrenaline isn’t there anymore.

So our subconscious minds find a reason to blow it all up and start again, or take unnecessary risks that will blow it up for us so we can start again and get back to homeostasis which is a high adrenaline state.

This “make it, spend it, risk it” cycle will continue until we become aware or it and resolve the underlying trauma at the root, or until we get too old to physically continue the cycle.

If the cycle isn’t broken before then, chances are extremely high that you will end up in your 70’s completely broke.

Step 3: Fall Back Onto Your Strengths…

When you’re going through a radically evolutionary process on a personal level, it’s easy to want to reject your past and move into something radically different.

But if you don’t have the financial situation to support that process which is like starting your entire life and career over from scratch, it can be nearly impossible.

When you’re struggling and trying to start over, usually the smartest move to make is to fall back onto your strengths.

I can’t tell you how many business ideas I had over the past 3 years.

I had changed dramatically as a person, and I wasn’t inspired by interviewing entrepreneurs and talking about business all day any more.

I wanted to get into deeper topics and conversations around personal transformation, spirituality, and plant medicines.

In fact, I built an entire podcast studio around the “Cosmic Ranch” brand I’d trademarked.

I had plans to launch (and still might someday), a health and supplement company built around detox.

I’d always known exactly who I was and what I wanted. But for the first time in my adult life, that wasn’t the case.

My identity had been turned into a puddle of goo and I was really struggling to figure out who I was and what I wanted to do next.

Every month I’d change my mind which was maddening.

But that struggle came to an end the moment I fell back onto my strengths… My ability to market online, and share the lessons I was learning.

This came to life in the form of Richer Every Day which shared the lessons I’d been learning about subconscious money programs… Combining financial education with deep personal development.

And Audience Factory which tapped into my strengths on building an audience and email list.

Once I took what I knew the best and combined that knowledge with my new insights and experiences, things took off…

Over 4,000 customers showed up to buy Richer Every Day and Audience Factory…

This generated around $3MM in revenue in the next 36 months.

I can say that I finally feel like I’ve found my purpose again.

Step 4: My Big Advantage…

In full transparency, I need to address the fact that I had a MASSIVE advantage that made this possible…

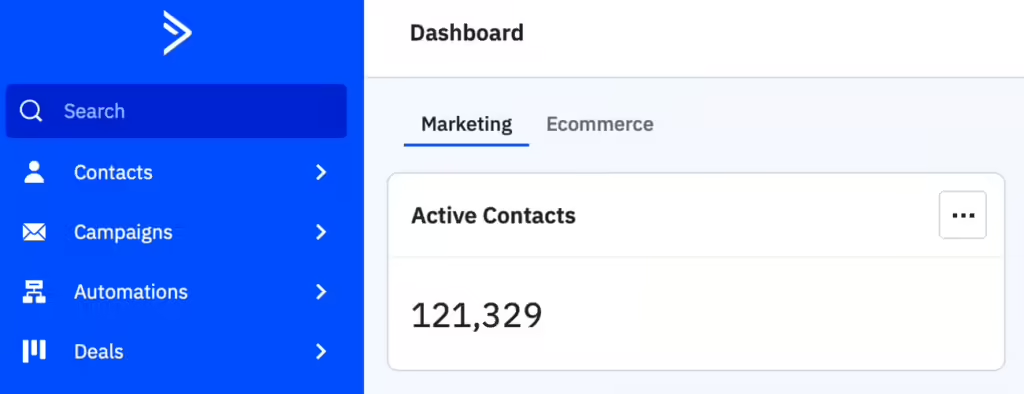

I still had my audience and email list.

I often went months without emailing you (my readers), because I just didn’t have the mental or physical ability to do so.

Obviously that’s not ideal, but having the ability to promote Richer Every Day and a few affiliate promotions was the foundation that I could rebuild upon.

I’ve always said that an email list is the most valuable asset any small business owner can build, and the past few years proved that to be the case in a massive way.

If you do not have an audience or email list, then you absolutely must make it your top priority.

There is nothing that can or will produce a larger return on your investment, especially during unexpected events…

Step 5: Creating New Money

Habits The Easy Way…

Once you become aware of your subconscious money programs and habits, the real magic happens when you start to change your behavior.

Building wealth is a habit. Nothing more, and nothing less.

Wealth is the result of the daily decisions you make when it comes to your money, and these new habits have get wired into your unconscious.

Why?

Because we’ll always fall back onto our default programming.

It’s why everyone quits the gym in February or March after making the conscious decision to lose weight on January 1st.

You can’t make a conscious goal and just say, “I’m going to start spending less money and making more today…”

Because the moment you experience stress, you’ll default back to your previous behaviors. That’s just how the brain works.

So you have to literally REWIRE your subconscious mind.

But here’s the amazing part…

Once you rewire in new programs that empower you to spend less and invest more without even thinking about it, building wealth literally becomes effortless.

It just happens automatically as a result of your new way of being.

Instead of “make it, spend it risk it”, your new programs will look like, “make it, keep it, invest it”.

So how do you rewire your mind for wealth?

That takes expert guidance and some pretty deep work.

The most powerful way that I’ve used is Timeline Therapy…

This allows you to go back to specific moments in your past when you made unconscious decisions that turned into subconscious programs around money….

The moments when your brain decided that you don’t have enough… Can’t make enough… Need to spend it… Need to risk it… Etc…

And then rewrite these life-changing memories into new ones that are actually aligned with your conscious goals.

Now the Timeline Therapy process is something that has to be done with a trained facilitator.

This is what we took people through over a 4 day period at our REWIRE events in person, and it’s exactly what Michelle does for her high-performance clients virtually.

If you really want to make some massive breakthroughs in your life when it comes to money, relationships, and success, I would highly recommend booking a call with her.

With that being said, please respect her time and don’t book a call unless you’re really serious about making these changes and are willing to invest a modest amount in yourself.

So these are the 5 steps that I took that allowed me to build my life back in just 2-3 years after losing almost every penny I’d ever made…

So Here’s My Question For You…

I’ve covered a lot of ground over the past week on some pretty big topics…

What would you like me to cover next, or go into more detail about?

What do you have questions about?

Shoot me a reply here and fire away… I’ll answer the best ones in my next email.

Sincerely,

Mike Dillard